Why Alternative Investing? An Essential Guide for Accredited Investors

Looking Beyond Wall Street

If you’ve been investing for a while, chances are your journey started with the classics: stocks, bonds, maybe a mutual fund or two. For decades, that was the standard path. But today’s landscape feels different. Inflation lingers, the stock market is unpredictable, and bond yields often don’t even keep pace with your grocery bill.

It’s no wonder accredited investors are looking for options that feel more stable, more predictable, and more aligned with long-term goals. Enter alternative investments, strategies that live outside the usual Wall Street playbook.

At Quattro Capital, we help investors tap into those opportunities. Through offerings like the Quattro Fixed Income Fund II (QFIF II), our mission is simple: build reliable income streams, protect your wealth, and give you the freedom to focus on what matters most in life.

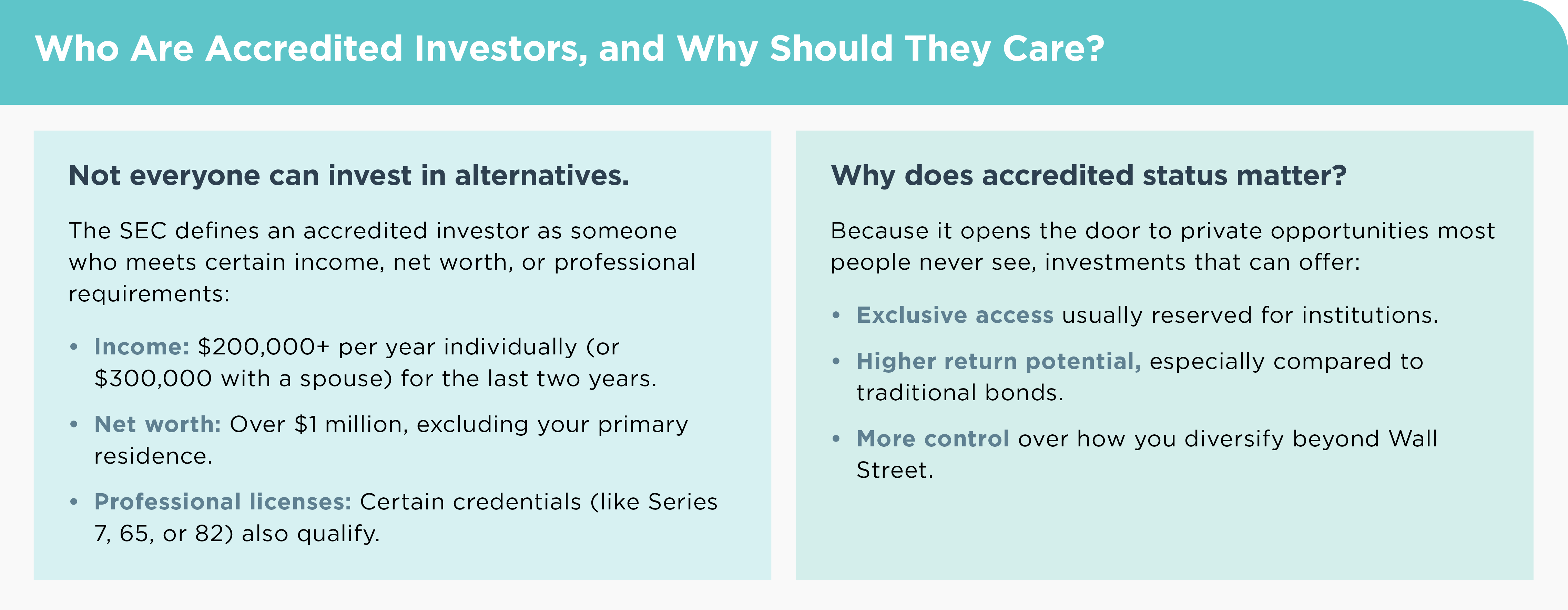

Who Are Accredited Investors, and Why Should They Care?

Not everyone can invest in alternatives. The SEC defines an accredited investor as someone who meets certain income, net worth, or professional requirements:

- Income: $200,000+ per year individually (or $300,000 with a spouse) for the last two years.

- Net worth: Over $1 million, excluding your primary residence.

- Professional licenses: Certain credentials (like Series 7, 65, or 82) also qualify.

So why does accredited status matter? Because it opens the door to private opportunities most people never see, investments that can offer:

- Exclusive access usually reserved for institutions.

- Higher return potential, especially compared to traditional bonds.

More control over how you diversify beyond Wall Street.

A practical example? Our Quattro Fixed Income Fund II. It’s built exclusively for accredited investors and targets 8–10% annual returns, backed by real assets like multifamily properties and gold. That’s the kind of access accreditation provides, and why alternatives deserve a place in your portfolio.

What Counts as an Alternative Investment?

“Alternative” simply means: not stocks, not bonds, not mutual funds. But that covers a lot of ground. Common categories include:

- Real Estate – multifamily apartments, commercial buildings, senior living.

- Private Equity – ownership in private companies.

- Hedge Funds & Venture Capital – specialized or growth-focused strategies.

- Commodities & Tangible Assets – gold, energy, farmland, and more.

What makes alternatives attractive?

- Defined commitments – Capital is invested for a set time, giving managers the runway to optimize performance.

- Low correlation – They don’t rise and fall every time the stock market does.

- Income potential – Many generate reliable passive cash flow.

- Resilience – Strong long-term performance, even through market turbulence.

Within Quattro, the simplest way to get started is with Quattro Fixed Income Fund II. It blends the stability of multifamily real estate with the security of gold-backed collateral, delivering predictable income in a straightforward structure.

Multifamily Real Estate: The Reliable Backbone

If there’s one alternative that’s consistently delivered for investors, it’s multifamily real estate. Think apartment communities, workforce housing, or senior living properties.

Here’s why it’s so powerful:

- Housing demand is resilient, even in recessions.

- Rental income provides consistent cash flow for investors.

- Leases reset annually, allowing rents to adjust with inflation.

- Economies of scale make a 100-unit building more efficient than 100 individual homes.

- Proven track record, with multifamily weathering economic storms better than many other assets.

That consistency is exactly why multifamily forms the backbone of Quattro’s strategies, and why it anchors the Quattro Fixed Income Fund II. Investors gain access to cash flow backed by real property, paired with the confidence that comes from collateralized security.

The Power of Non-Correlation: Why It Matters Right Now

This is one of the most important but least understood benefits of alternatives: they don’t always move with the market.

Traditional assets like stocks and bonds often move together, especially when the market gets rocky. That can leave your entire portfolio exposed to the same storm.

Multifamily real estate and funds like Quattro Fixed Income Fund II, don’t follow that script. They provide a buffer against Wall Street swings.

Picture it like this: if all your investments are in the stock market, you’re on one boat. When the waves hit, the whole thing rocks. Add alternatives like multifamily-backed fixed income, and suddenly you’ve got a fleet. Even if one vessel takes on water, the others keep you steady.

Why Work with Quattro Capital?

At Quattro, we know investing isn’t just about money, it’s about what money makes possible. Our investors earn steady, predictable income, but the real story is what they do with it: more time with family, more opportunities to give back, more freedom to design the life they want.

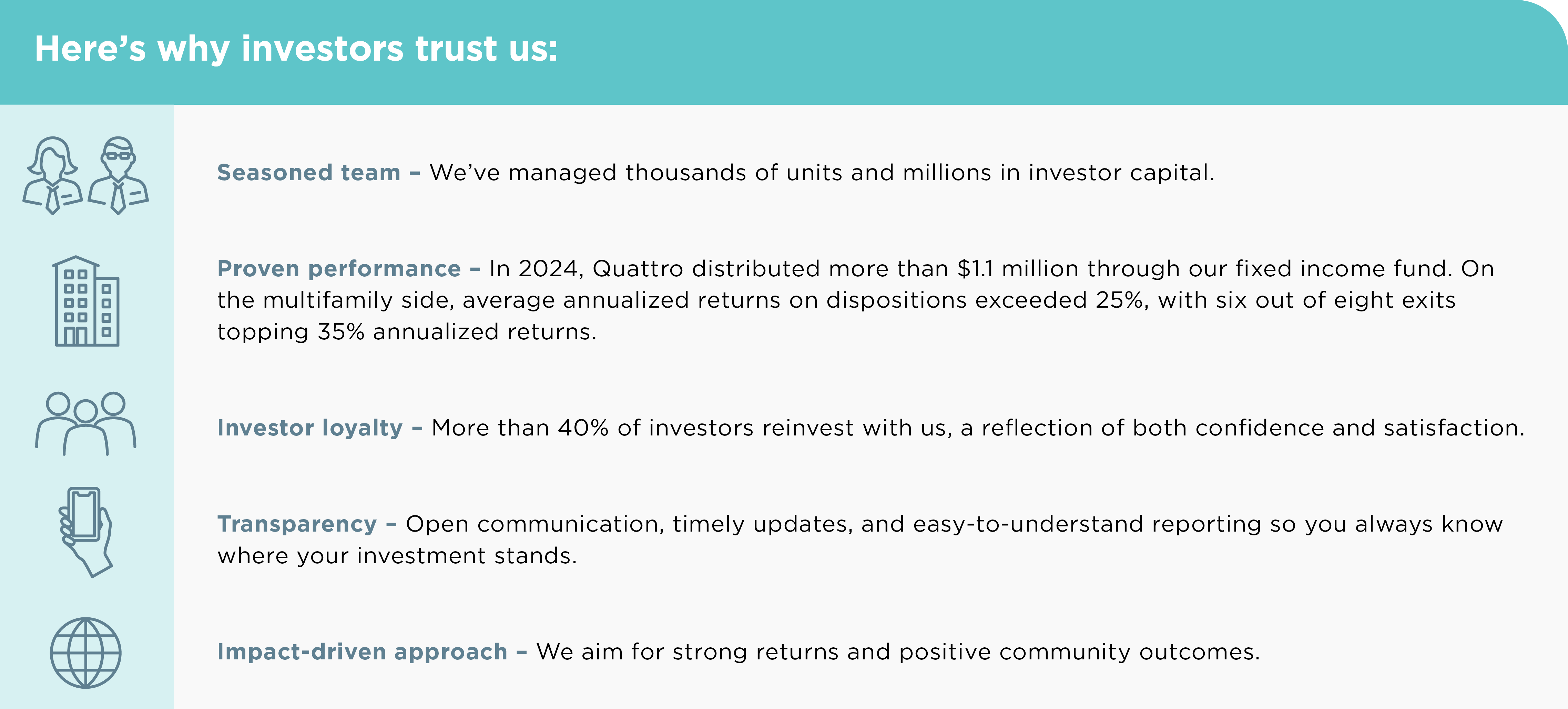

Here’s why investors trust us:

- Seasoned team – We’ve managed thousands of units and millions in investor capital.

- Proven performance – In 2024, Quattro distributed more than $1.1 million through our fixed income fund. On the multifamily side, average annualized returns on dispositions exceeded 25%, with six out of eight exits topping 35% annualized returns.

- Investor loyalty – More than 40% of investors reinvest with us, a reflection of both confidence and satisfaction.

- Transparency – Open communication, timely updates, and easy-to-understand reporting so you always know where your investment stands.

- Impact-driven approach – We aim for strong returns and positive community outcomes.

That’s what makes the Quattro Fixed Income Fund II more than just another investment, it’s a way to earn with confidence, knowing your capital is working hard, secured by real assets, and aligned with a partner who puts you first.

Conclusion: A Smarter Way to Build Wealth

Alternative investments give accredited investors something Wall Street struggles to deliver: income you can count on, protection for your capital, and long-term growth potential.

At Quattro Capital, we’re here to guide you through these opportunities with clarity and confidence. Whether through multifamily partnerships or structured offerings like the Quattro Fixed Income Fund II, we believe investing should be both profitable and purposeful.

Ready to take the next step?

Schedule a strategy call with one of the managing partners at Quattro Capital, because building wealth is only half the story. The real goal is amplifying your life.

About Author

Quattro Capital Team

The Quattro Team is passionate about helping investors achieve financial freedom through smart asset backed investments. We combine deep market knowledge with a people-first approach to create wealth and impact for our partners and communities.

.png)

.png)

-1.png)

.png)

Comments