Multifamily Operators That Meet Institutional Standards

.png?height=420&name=Blog%20%20Images%20(19).png)

Observations from Family Office Allocation Reviews

Key Takeaways

Characteristics consistently present in multifamily platforms that advance through institutional review

- Institutional allocators prioritize repeatable risk discipline over individual deal performance.

- Conservative underwriting, leverage restraint, and transparency are baseline expectations.

- Investment committee discussions center on process quality, downside protection, and governance.

- Multifamily remains a core allocation when operating platforms demonstrate institutional maturity.

How Multifamily Operators Are Typically Evaluated at the Institutional Level

Within family offices and advisory firms, multifamily operators are evaluated through structured review processes designed to protect capital before upside is considered.

The emphasis is rarely on projections alone. Reviews focus on whether an operator’s platform, assumptions, and governance align with long-term fiduciary mandates. Only those that meet institutional standards tend to advance to deeper diligence and committee discussion.

The observations below reflect themes that consistently surface in family office allocation reviews.

Market Discipline as a Baseline Expectation

In institutional reviews, market selection is evaluated before individual deals are considered.

Family offices tend to favor operators active in markets with diversified employment, durable housing demand, manageable supply pipelines, and regulatory stability. Markets dependent on narrow growth narratives, speculative population inflows, or outsized new supply are often screened out early.

Operating platforms that treat market selection as a risk control rather than a growth lever tend to align more closely with institutional objectives.

Underwriting Viewed as a Risk Model

In family office diligence, underwriting is typically assessed as a risk model rather than a forecast.

Investment committees expect assumptions that reflect friction, volatility, and imperfect execution. Conservative rent growth grounded in historical performance, realistic expense assumptions, exit scenarios that account for cap rate expansion, and sensitivity analysis across occupancy, interest rates, and timing are standard components of review.

Operators whose underwriting remains viable under stress are more likely to advance through institutional evaluation.

Leverage Evaluated for Optionality, Not Enhancement

Capital structure is often one of the clearest differentiators during screening.

Family offices generally assess leverage through the lens of flexibility and downside protection. Loan-to-value levels, interest rate exposure, reserve adequacy, and refinance optionality are reviewed closely. Excessive leverage is frequently viewed as a constraint on decision-making during market disruptions rather than a source of return.

Platforms that use leverage conservatively to preserve optionality tend to align better with long-term capital preservation goals.

Patterns Observed in Initial Operator Screening

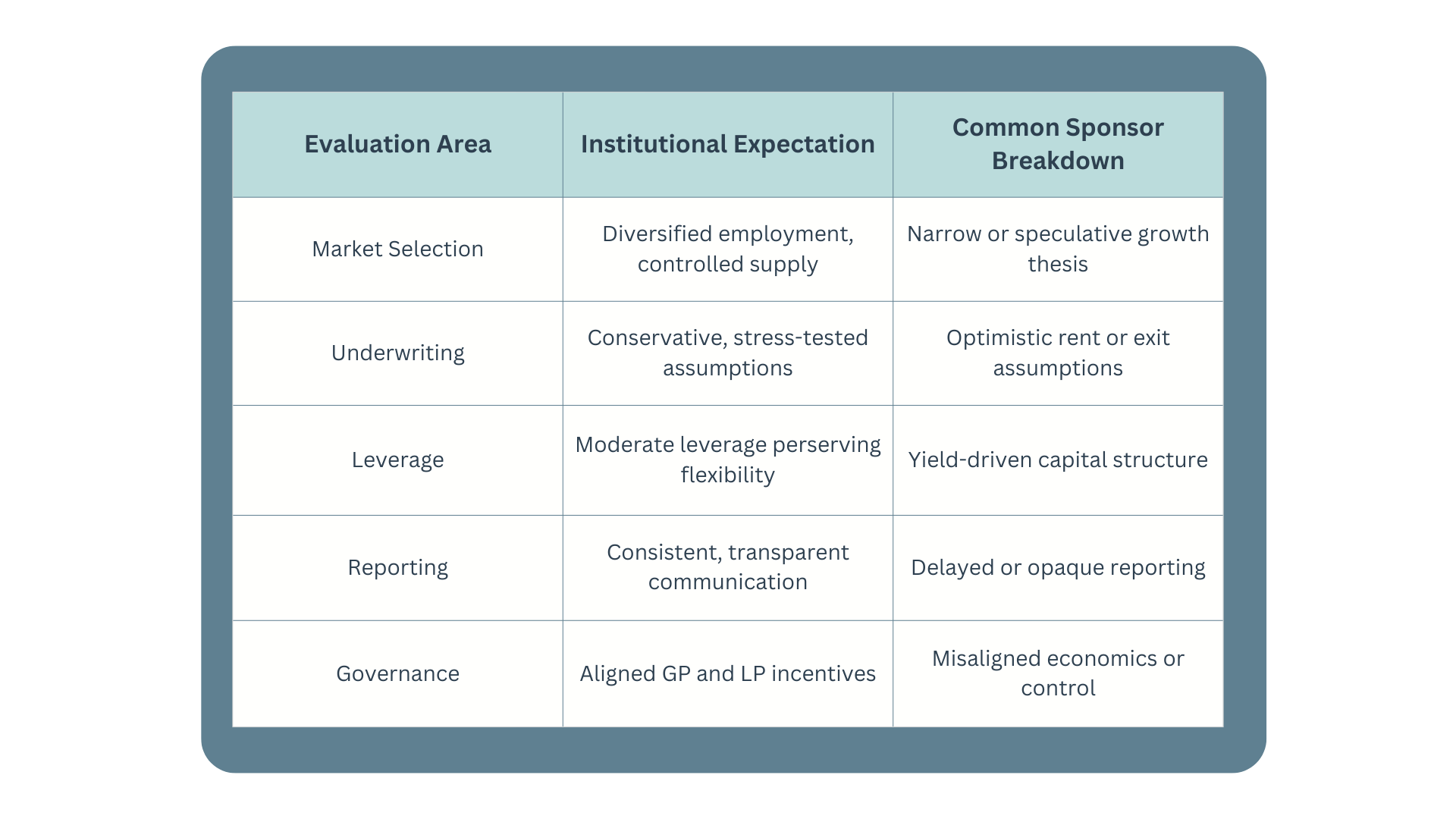

The table below reflects common patterns observed during early-stage institutional reviews of multifamily operators.

These factors frequently determine whether an operator advances to deeper diligence or is removed from consideration.

Operator Quality Assessed Across Market Cycles

Institutional allocators invest in operating platforms, not highlight reels.

Track record reviews extend beyond performance metrics to include how operators navigated periods of stress, how decisions were communicated during underperformance, and whether incentives remained aligned as conditions changed.

Consistency across market cycles is often weighted more heavily than peak-period outcomes.

Reporting and Governance as Fiduciary Infrastructure

In family office environments, reporting is not viewed as an administrative function. It is part of the risk management framework.

Institutional reviews tend to favor operators that provide consistent reporting cadence, clear explanations of performance drivers, visibility into reserves and debt, and proactive communication when assumptions shift. Strong reporting supports informed committee discussions and long-term allocation confidence.

Weak or inconsistent reporting increases perceived risk regardless of realized returns.

Why These Standards Matter in the Current Multifamily Environment

The multifamily market has recalibrated.

The period of abundant liquidity, compressed cap rates, and margin for error has passed. Capital is increasingly allocated to platforms that demonstrate conservative assumptions, disciplined execution, and governance capable of operating through uncertainty.

Family offices are not exiting multifamily. They are refining standards.

Platforms built around institutional discipline continue to earn allocations in this environment.

Frequently Asked Questions

How do family offices typically source multifamily operating platforms?

Family offices most often encounter operators through trusted referrals, existing relationships, and repeated exposure across transactions. Platforms that demonstrate institutional discipline tend to surface consistently across these channels.

What most often prevents a multifamily operator from advancing in institutional review?

Common barriers include aggressive leverage, unrealistic underwriting assumptions, inconsistent reporting, and misalignment between GP and LP incentives.

Are family offices still allocating to multifamily real estate?

Yes. Allocations continue, but capital is directed toward platforms with strong downside protection, governance, and repeatable execution.

What carries more weight than projected returns in committee discussions?

Process quality, risk discipline, transparency, and the ability to operate through market cycles typically outweigh headline return projections.

Why is reporting emphasized so heavily in family office reviews?

Reporting functions as fiduciary infrastructure. Clear, consistent reporting supports confidence, accountability, and proactive risk management throughout the investment lifecycle.

Closing Perspective

Family offices are not seeking the highest projected return.

They are seeking operating platforms that understand risk, communicate clearly, and steward capital responsibly across market cycles. Multifamily remains a durable allocation when evaluated through this lens.

Quattro Capital is structured to operate within these institutional standards because this is how sophisticated capital is typically evaluated, approved, and deployed.

Institutional Inquiry

For family offices, advisory firms, and gatekeepers conducting operator reviews, our team is available to provide institutional materials and discuss alignment.

About Author

Quattro Capital Team

The Quattro Team is passionate about helping investors achieve financial freedom through smart asset backed investments. We combine deep market knowledge with a people-first approach to create wealth and impact for our partners and communities.

.png)

.png)

-1.png)

.png)

Comments